TCS on Remittance

Summary: In this blog, you’ll learn about how Tax Collected at Source (TCS) applies to foreign remittances and forex transactions under India’s tax laws, including key rates and exemptions.

Table Of Content▼

Table Of Content

- What Is TCS on Foreign Remittance

- Why is TCS on Foreign Remittance collected?

- TCS Applicability & Key Compliance Requirements

- Who collects TCS?

- Key Compliance Points on TCS

- New TCS Rates on Foreign Remittances (Effective April 2025)

- TCS on Outward Remittance Transactions: Key Points

- Here the key points on TCS for Outward remittance:

- How TCS Is Collected on Foreign Remittance

- How to Check TCS Deducted

- How to Claim TCS Refund

- Frequently Asked Questions (FAQs)

Foreign remittance (from India to abroad) is the cross-border transfer of money, for purposes like family support, education, or investment, governed by FEMA (Foreign Exchange Management Act) and RBI guidelines, with specific limits for residents under the Liberalised Remittance Scheme (LRS) and different rules for NRIs.

To monitor high value foreign remittance transactions and strengthen compliance, the GOI levies Tax Collected at Source(TCS) on Foreign remittances under Liberlised Remittance Scheme(LRS) of RBI.

In this guide we are going to explain what TCS is, when it is applicable, how it is collected, what is latest TCS rates & how you can claim a refund.

What Is TCS on Foreign Remittance

It is a form of advance income tax collected by authorized dealers[AD] such as Banks & RBI authorized forex dealers like Orient Exchange at the time of sending money abroad(foreign remittance).

| You Should Know: |

|---|

| TCS on foreign remittance is paid only by Indian residents under LRS. |

| TCS on foreign remittance is governed by Section 206C(1G) of the Income Tax Act, 1961. |

Why is TCS on Foreign Remittance collected?

- To track international spending by Indian citizens

- To ensure better tax transparency

- To widen tax base in India

Important: TCS is not an additional tax burden, it can be refundable or adjusted against your total income tax liability while filing your ITR return.

TCS Applicability & Key Compliance Requirements

TCS applies to Indian residents who makes foreign remittances under LRS.

|Also Read : LRS Guide

Who collects TCS?

Generally Banks & RBI Authorized dealers like Orient Exchange who are licensed to process Outward remittances leivy TCS on Foreign Remittance.

Key Compliance Points on TCS:

- PAN is mandatory while collecting TCS

- TCS is collected at the time of remittance

- TCS certificate (Form 27D) is issued

- TCS credit reflects in Form 26AS

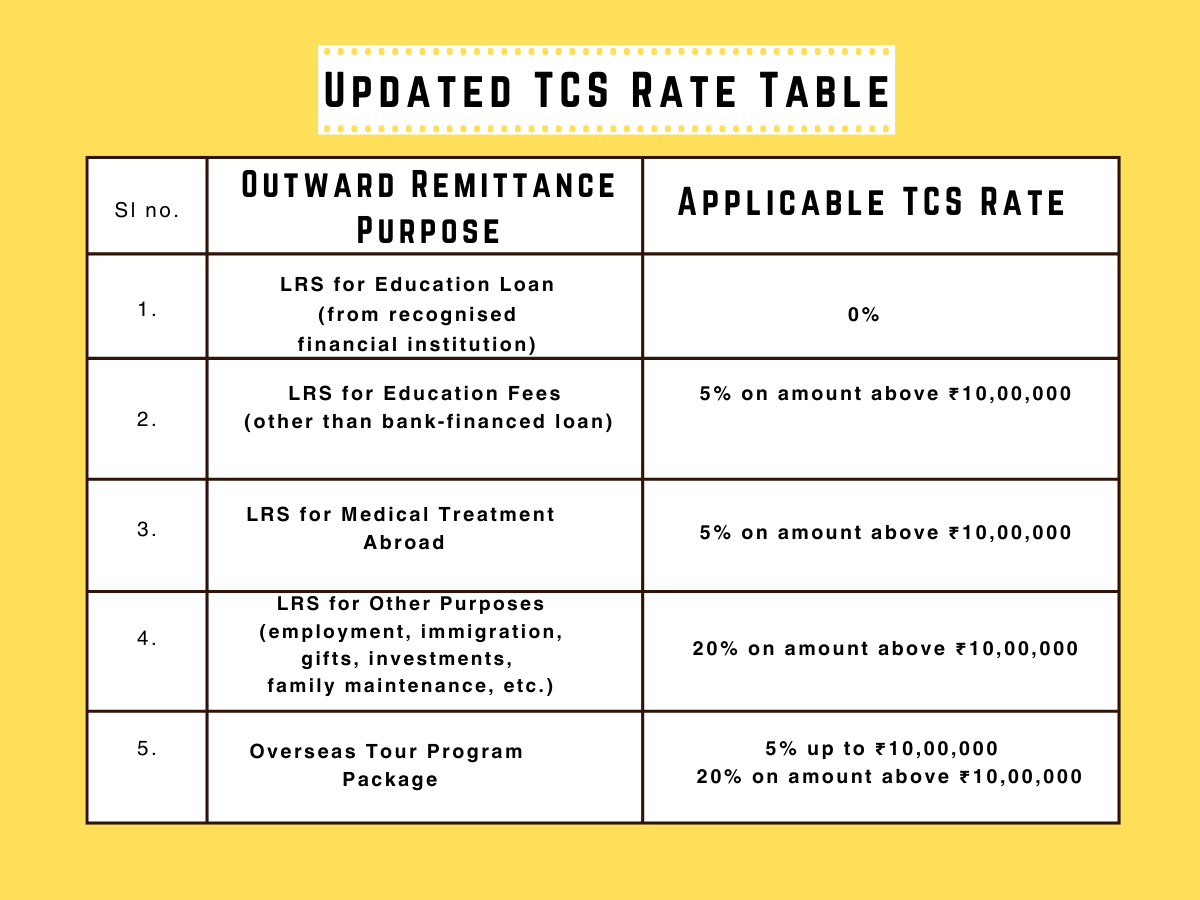

New TCS Rates on Foreign Remittances (Effective April 2025)

As per the latest guidelines effective April 2025 onwards, TCS applies once your total foreign remittance exceeds ₹10,00,000 in a financial year, unless otherwise specified.

- LRS for Education Loan (from a recognised financial institution):TCS rate is 0%.

- LRS for Education Fees (other than bank-financed loan):TCS of 5% is applicable on the amount exceeding ₹10,00,000.

- LRS for Medical Treatment Abroad: TCS of 5% applies on the amount exceeding ₹10,00,000.

- LRS for Other Purposes (such as employment, immigration, gifts, investments, family maintenance, etc.):TCS of 20% is applicable on the amount exceeding ₹10,00,000.

- Overseas Tour Program Package:TCS of 5% is applicable up to ₹10,00,000, and 20% is applicable on the amount exceeding ₹10,00,000.

TCS on Outward Remittance Transactions: Key Points

Outward Remittance refers to sending money from India to Abroad within RBI regulations such as LRS, permissible purposes.

Here the key points on TCS for Outward remittance:

- TCS is calculated on the aggregate remittance amount in a FY

- Multiple remittances in financial year are clubbed together

- TCS is collected before funds are transferred

Consider:Orient Exchange is a RBI licensed Outward Remittance platform ensures accurate TCS calculation and complete regulatory compliance for every transaction.

How TCS Is Collected on Foreign Remittance

Under RBI’s LRS rules, Authorized Dealers track all foreign remittances made by an individual in a financial year.

Once total remittances cross ₹10 lakh, TCS is collected at the applicable rate at the time of transfer.These remittance and TCS details are reported to the Income Tax Department and appear in Form 26AS/AIS on the Income Tax portal.

For Example

If you want to remit ₹15,00,000 for overseas education (without an education loan):

First ₹10,00,000 → No TCS

Remaining ₹5,00,000 → 5% TCS = ₹25,000

How to Check TCS Deducted

You can verify the TCS collected using:

Form 27D

- Issued by the authorised dealer

- Serves as proof of TCS collection

Form 26AS

- Available on the Income Tax Porta

- Displays TCS credit linked to your PAN

- Always ensure your PAN details are correct to avoid discrepancies.

How to Claim TCS Refund

TCS can be claimed while filing your Income Tax Return (ITR).

Steps to Claim Refund

- Obtain Form 27D from authorised dealer

- Verify TCS credit in Form 26AS

- File your ITR and declare TCS paid

- Excess TCS (if any) is refunded by the Income Tax Department

Frequently Asked Questions (FAQs)

►Is TCS applicable to NRIs?

No. TCS under LRS applies only to resident Indians.

►Is PAN mandatory for foreign remittance?

Yes. PAN is compulsory for TCS compliance.

►Is TCS inclusive of GST?

No. TCS and GST are separate charges.

►Can TCS be avoided?

TCS cannot be avoided if applicable, but it can be claimed back as a refund.

► Why Choose Orient Exchange for Foreign Remittance?

- RBI-authorised dealer

- Transparent and accurate TCS calculation

- Better exchange rates than banks

- Complete documentation support

- Dedicated support team for foreign remittance assistance

➡ Get Foreign Remittance assistance with Orient Exchange today!

• · ✦ · • Article Ends Here • · ✦ · •

Contact Us